Ben Sutcliffe-Davies reports…

Paul Knox-Johnston, sales and marketing manager of Haven Knox-Johnston, gave a presentation at the show about some of the most common narrowboat claims. I helped put together some of the topics and want to help pass on the main information to help you avoid a claim. This will be part one of a series…

Basics

Firstly, check your cover with your insurance company: most owners do have fully comprehensive cover but, often when attending a serious claim where there’s been a fire or sinking and the owner has basically lost everything, I find some of the ‘options’ of the cover are never taken up.

For instance, if you are a liveaboard, then do declare that. Also, ensure you have covered personal effects and really consider the ‘alternative accommodation’ option. If you have taken out just third-party insurance cover, make sure wreck removal is provided and that the level of cover paid is stated. I’ve dealt with several claims through this last winter where the cover of £15,000 recovery wasn’t anywhere near enough for refloating, towage and bringing ashore. It doesn’t, in many cases, cover disposal of the wreck… that fee alone can also become a telephone number.

Most claims drop into one of the main categories that include: boat fires, sinking or significant water ingress, collisions, theft or vandalism and weather-related damage. Some insurance companies also cover mechanical cover but there has to be a causation. Each of these categories can often lead to significant repair costs or even total loss of your boat; do look at the value of your boat and consider whether it is correctly insured.

Devastating

Fire is always a devastating incident and, in many cases, while the seat of the fire is often contained to one small area, when it breaks out, it will in most cases quickly spread. It is essential to make sure you have at least two ways out, with smoke alarms and carbon monoxide alarms all tested and working. When a fire gets hold the basic fire extinguishers on board will never be enough, the smoke and heat damage to the cabin shell will in most cases make the craft uneconomical to repair against the boat values, in most cases. It further reinforces why, if you are a liveaboard, to ensure you have alternative cover in place. I carry on my boat a 1kg 8B/38B fire extinguisher in every cabin plus a 6kg foam as a backup and a fire blanket.

Common causes of fire

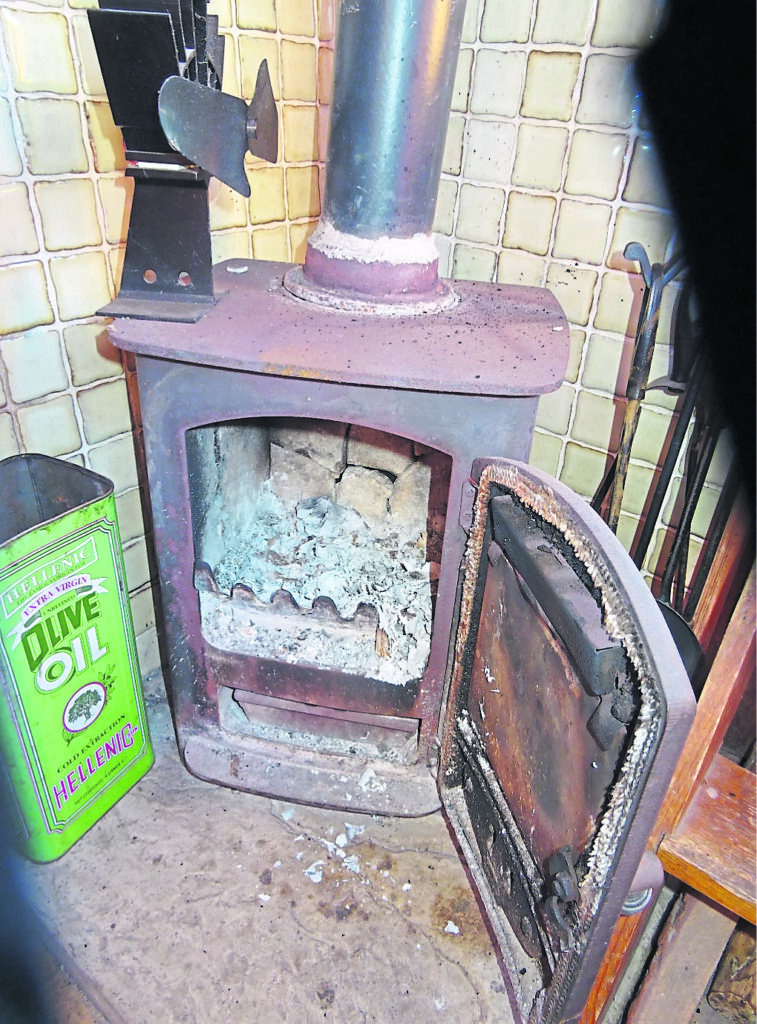

Stoves should be professionally installed, with proper heat shielding and compliant. The lack of heat shielding, especially the hearth arrangements, is one of the most common cause of fires. Never leave a stove burning unattended overnight. Any of the insurers – whoever they are – expect you to regularly service stoves and clean out flues. These regularly get soot deposits from when burning damp timber that makes perfect creosote that’s highly flammable! I’m often told by claims departments that having insurance does not negate the requirement to be responsible and maintain your stove.

It’s not just stoves that can be the cause of a boat fire. Other forms of heating also come with risks, whether it’s an electric fan heater or a diesel fired heating system. If poorly maintained or left unattended, these can all be a potential fire hazard. This last year I dealt with a high number of ‘cheap’ ceramic plug-in fan heaters causing fires on board when left unattended.

Fire is a major devastation, however large or small. Check your insurance policy details, do your safety checks, and be responsible for ensuring your vessel’s maintenance is up to date.